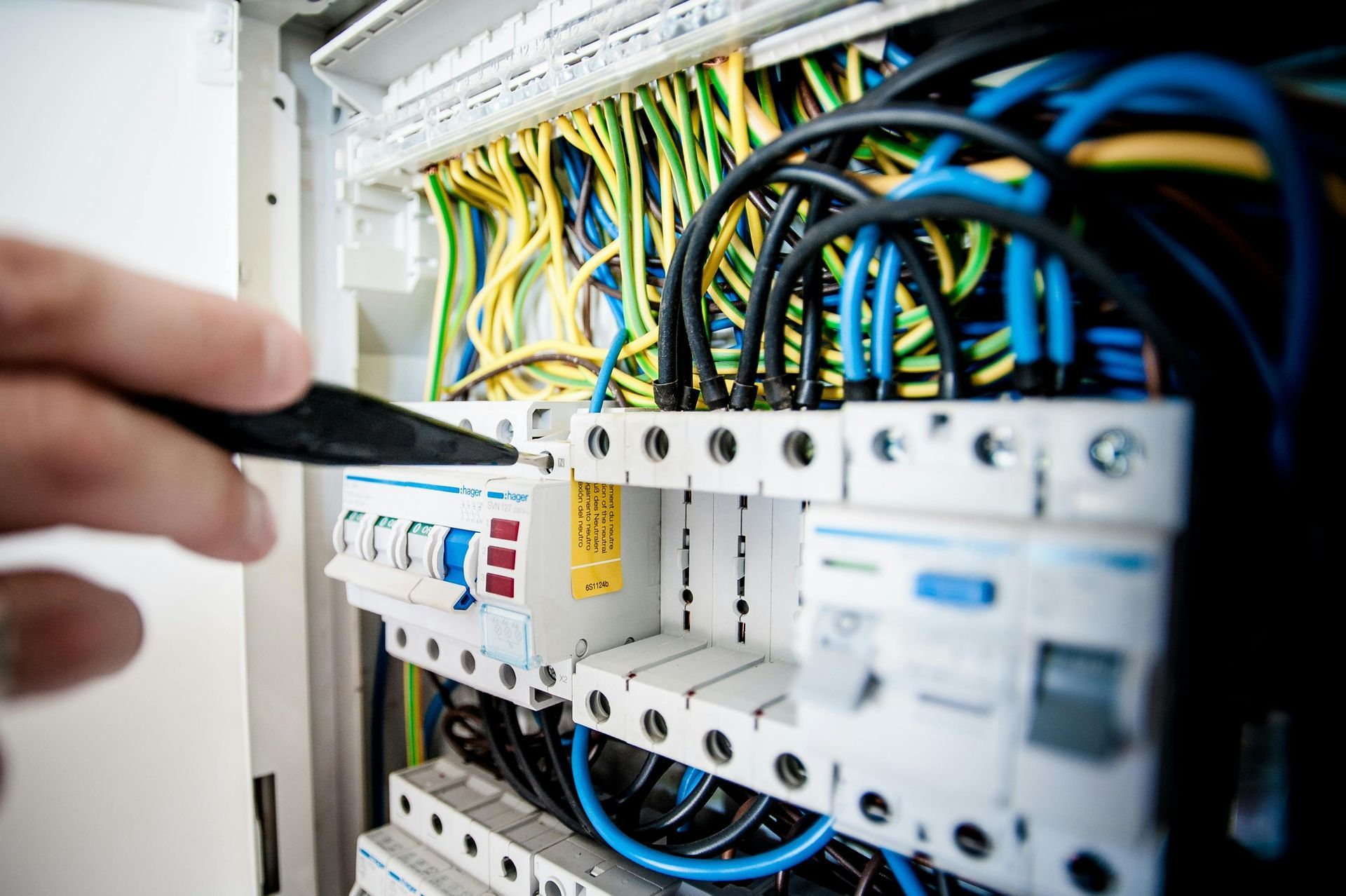

Responding to emergency maintenance requests is a vital aspect of property management. Whether it's a sudden plumbing issue or an electrical malfunction, these situations demand swift and precise action to protect the property and ensure tenant safety. Handling Emergency Maintenance Requests. Establishing a 24/7 Maintenance Hotline A dedicated 24/7 maintenance hotline allows tenants to report emergencies anytime. This proactive measure ensures property management teams can immediately address urgent issues like burst pipes or electrical failures, minimizing damage and inconvenience. Collaborating with Trusted Vendors/ Contractors At Hunter Rentals, we’ve forged strong partnerships with reliable contractors and service providers, including plumbers, electricians, and HVAC specialists. These trusted professionals are ready to respond at short notice, ensuring repairs are handled efficiently while maintaining property standards and minimizing downtime. Prioritizing Repairs Based on Urgency Prioritizing repairs by assessing the severity of an issue is vital in case of an emergency. For example, a flooding emergency would take precedence over a minor appliance malfunction. This systematic approach ensures critical problems are resolved quickly, reducing potential risks. Implementing Preventative Maintenance Plans Preventative maintenance is key to reducing emergencies. We conduct regular inspections to identify potential issues before they escalate. For example, checking for signs of water leaks or faulty wiring can prevent larger problems, protecting the property. Using Technology to Streamline Repairs Modern property management involves using software systems to track maintenance requests and organize repairs. These tools ensure that no request is overlooked. By assigning tasks, monitoring progress, and maintaining detailed records of completed work, we uphold high service standards while resolving issues efficiently. Communicating Transparently with Tenants Clear communication is key during emergency maintenance situations. We keep tenants informed about repair timelines and updates. This transparent approach helps build trust, encourages cooperation, and reassures tenants that their concerns are being promptly addressed. Documentation At Hunter Rentals, we keep detailed records of emergency maintenance requests, including the nature of the issue, urgency, and actions taken. These records help identify recurring problems, monitor trends, and serve as valuable references for future planning. In legal matters, detailed documentation protects both tenants and property owners by providing an accurate repair history. Follow-Up We always follow up with tenants after repairs to confirm their satisfaction and ensure the problem has been fully resolved. This extra step demonstrates our commitment to excellence, fosters trust, and reinforces tenant loyalty. Prompt action in emergencies not only safeguards the property but also enhances tenant satisfaction. For more information about property management in Killeen, TX, visit Hunter Rentals & Sales, at 1503 W Stan Schlueter Loop, Killeen, TX 76549, United States, or call (254) 634-3311. You can also browse at www.hunterrentals.com and connect on Facebook and Instagram for the latest updates.

B uilding a successful rental property portfolio requires careful planning, strategic decision-making, and a clear understanding of the real estate market. By focusing on sound investment practices and staying informed about market trends, investors can create a portfolio that generates consistent income and long-term growth. Here are key strategies to expand and manage a rental property portfolio effectively: Setting Clear Investment Goals Investors should define their financial objectives, preferred property types, and target markets before acquiring new property assets. Determine whether your focus is on long-term appreciation, short-term cash flow, or a balanced combination of both. Clear goals will serve as a roadmap to guide your investment strategy. Diversifying Property Types and Locations Investors can expand their portfolio by including a mix of property types such as single-family homes, 2-to-4 units, or commercial multifamily apartments. Additionally, investing in diverse geographic locations can reduce reliance on a single market’s performance. Diversification provides stability and mitigates risks, especially during economic fluctuations. Exploring Financing Options Understanding and leveraging various financing options is essential for portfolio growth. Mortgages, lines of credit, and partnerships can help fund new acquisitions without exhausting your capital. Carefully choose financing methods that align with your cash flow and budget goals to maintain financial flexibility and minimize risk. Focusing on High-Growth Markets Investing in high-growth markets can maximize rental income and property value appreciation. Look for neighborhoods experiencing population growth, job creation, and infrastructure development. These areas typically attract tenants and ensure consistent demand. Conduct thorough research to identify markets that align with your long-term profitability goals. Cash Flow Monitoring Managing cash flow is critical for sustaining a healthy rental portfolio. Regularly review the income and expenses of each property, including maintenance costs, property taxes, and operational fees. To optimize cash flow, consider adjusting rent to market rates, minimizing unnecessary expenses, or implementing cost-effective property management solutions. Comprehensive Market Research Investors must stay informed about real estate market trends to make strategic investment decisions. Analyze local rental rates, neighborhood developments, and tenant preferences. This knowledge can help one position properties competitively and anticipate shifts in demand, ensuring the rental portfolio remains resilient. Leverage Property Management Services As the rental portfolio grows, managing multiple properties can become overwhelming. Hiring a property management company can ensure high standards across all properties. Professional property management takes care of services like tenant screening, rent collection, and property maintenance; ensuring that tenants remain satisfied and properties stay in top condition. Prioritize Property Maintenance and Upgrades Regular maintenance and upgrades keep properties in excellent condition and enhance their appeal and valuation. Investors should consider modernizing properties with energy-efficient solutions or installing updated appliances to attract quality tenants and potentially increase rental income. Well-maintained properties contribute to tenant retention and overall portfolio stability. For more information about expanding your rental property portfolio, visit Hunter Rentals & Sales, at 1503 W Stan Schlueter Loop, Killeen, TX 76549, United States, or call (254) 634-3311. You can also browse at www.hunterrentals.com and connect on Facebook and Instagram for the latest updates.